MyCardStatement is an online portal where account holders analyze their spending, view their credit card statements, and pay bills online. You can also view their recent transactions, check for any fraud activities, and provide cash assistance. With MyCardStatement Portal, Credit card holders can add & manage multiple credit cards to their mycardstatement.com account for simple & fast transactions to win reward points in return.

Accessing MyCardStatement online portal that enables cardholders to pay credit card bills online through an official website by logging on to mycardstatement.com portal. After accessing your account, you can Analyze your spending, and review your statements.

Login into the MyCardStatement Account Portal

It offers a range of security features to ensure the protection of your personal and financial information. With a secure login portal and encrypted data transmission, you can have peace of mind knowing that your information is protected. Furthermore, with mycardstatement.com account portal, you can monitor your account activity in real-time, and you can quickly detect any suspicious transactions and take action to prevent any potential fraud contact customer care number.

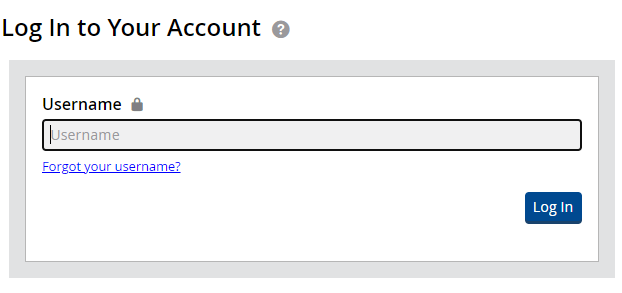

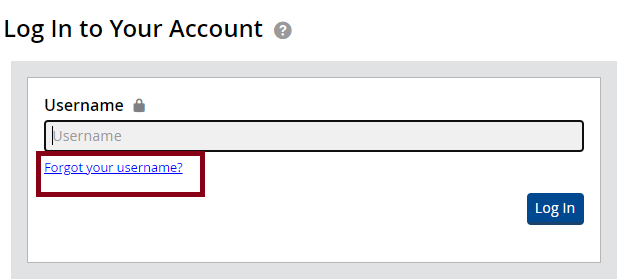

It is a straightforward process that allows you to access your card information online. To log into Portal, you need the login credentials that you have given while registering your Account. Here we are providing the step-by-step process to log in to the portal, just follow.

- To pay for your credit card, please Log into MyCardStatement’s Official Website: www.mycardstatement.com.

- On the Sign-In page, Enter your username in the required fields and click on the login button.

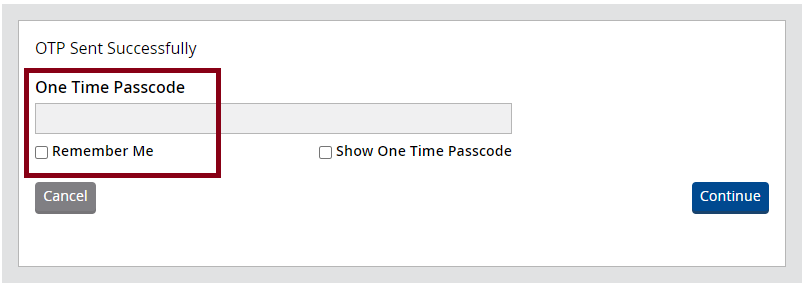

- Now select OTP delivery option to send SMS or phone call to your registered phone number and click on continue.

- For the registered phone number you will receive OTP, whether the OTP got from either SMS or Call.

- Enter OTP in the One Time Passcode field and then click on continue

- If the entered OTP is correct then the page redirects to the login portal page and access your business details.

- If the entered OTP is incorrect, then you need to reset your username by clicking forgot username from the login credentials page.

If you have forgotten your username, Login page have a “forgot password” option click on it, which will allow you to reset your password and access your account.

Register at PrepaidGiftBalance legit – Official Site (www.prepaidgiftbalance.com)to activate card Check your prepaid gift balance.

Register with MyCardStatement Website Portal

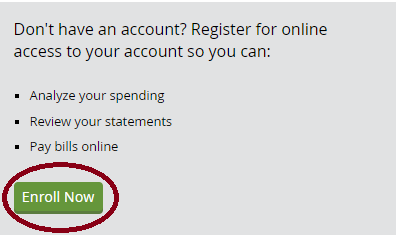

By registering an account with MyCardStatement, Sign-Up Process For New Users to Pay credit card bills. You can enroll to be a member by signing up with your name and valid credit card information. If you haven’t registered yet. complete the signing up process for new users to enjoy the benefits.

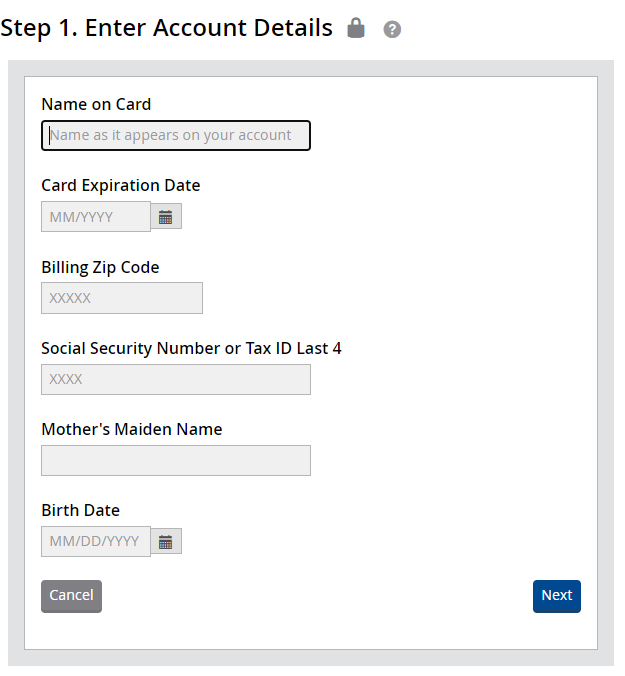

To register or sign up for new account, user needs to enter the following the enrollment process.

- Visit: www.mycardstatement.com.

- After visiting the official website, Click on the enroll now button.

- When you click on the “Enroll Now” button, the webpage redirects to the enrollment page.

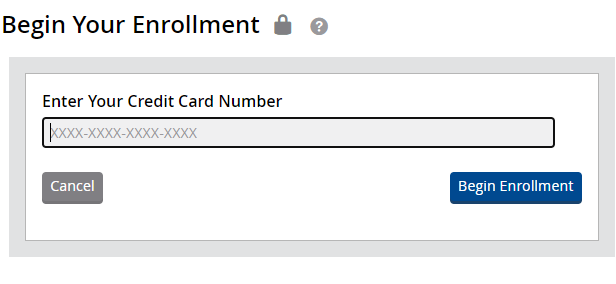

- To begin your enrollment process, Enter Your Credit Card Number on the screen.

- After entering 16-digit credit card number, once again check the numbers which you have entered and click on begin enrollment.

- Now enter the card details like name, expiration date, and last four digits of the company’s tax ID and click on next button.

- Provide the required information like creating a username, password, email address, and nickname.

- Answer security question, and remember the answer which you have given.

- Finally click on finish button.

Once you have completed registration or sign up for new account, you will be able to secure card and view your credit card information, transactions, payments, statements etc.

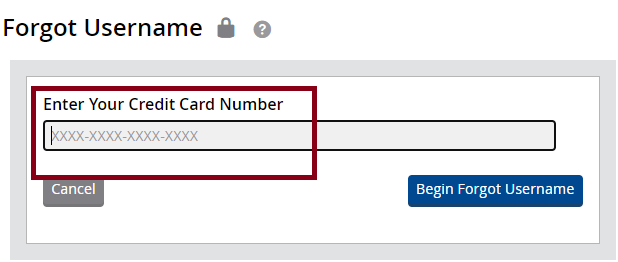

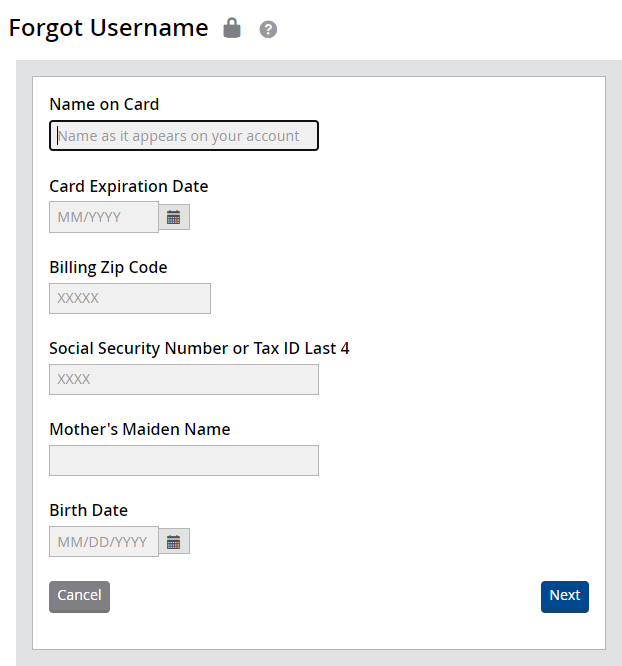

Forgotten Username

The process of recovering a forgotten username is a simple process. You can recover it by following these steps:

- Please Login to Official Website of Mycardstatement portal, www.mycardstatement.com

- Click “Forgot your username” link, from official login page.

- Provide the required information, such as Enter your credit card number to verify your identity and click on “Begin Forgot Username“.

- Now provide your details like Name on card, card expiration date, Billing Zip code, Social Security Number or Tax ID Last 4, Mother’s Maiden Name, Birth Date, and click on Next.

- Follow the instructions to recover your username, which may include answering security questions or receiving a one-time code via email or text message.

- Once your identity is verified, it will provide you forgotten Username.

Why do we use MyCardStatement ? Benefits/Features

Cardholders use benefits from their MyCardstatment account not only for credit card payments but to get offers and rewards online. The benefits of using this logging into portal may include:

- Convenient access to Account information: Cardholders can view their current balance, recent transactions, and account details anytime and anywhere with an internet connection.

- Paperless statements: By opting for electronic statements, cardholders can help reduce paper waste and keep their financial information organized and accessible.

- Easy tracking of spending: Cardholders can view their transactions, Gift cards, Rewards and spending patterns, which can help them make informed decisions about their finances.

- Quick resolution of disputes: If a cardholder suspects a fraudulent transaction, they can easily review their account-details and transactions for making it easier to resolve any disputes with the issuer.

- Enhanced security: Cardholders can monitor for suspicious activity and quickly report any unauthorized charges.

- Time-saving: Cardholders no longer need to wait for a paper statement to arrive in the mail to review their account information.

- Customizable alerts: Some services allow cardholders to set up customizable alerts, such as balance reminders or transaction notifications, which can help them stay on top of their finances and avoid overspending.

- Easy payments: Many services also provide an online platform for making payments, which can be a convenient and secure way to manage your bills.

- Improved budgeting: With up-to-date information on spending and transactions, cardholders can use to track their expenses and better manage their budget.

- Environmentally friendly: By opting for electronic statements, cardholders can reduce paper waste and make a positive impact on the environment.

Not all credit card issuers provide Visa, hence the particular advantages and features could change based on the issuer and the kind of credit card. Instead of buying chegg.com subscriptions, utilize homeworkify to discover answers; you are wasting money paying for everything.

MyCardStatement Features

Features of My Card Statement allows the customers with access their benefits and perks along with their credit card information online. Here are some of the key features that offers:

- Real-Time Access to Account Information: You can view your recent transactions, check your account balance, and monitor your account activity in real-time.

- Payment management: You can make payments directly from your , set-up automatic payments, and view payment history.

- Transactions history: It provides a detailed history of all transactions, including date, amount, and merchant information.

- Statement management: You can view and download credit-card statements directly.

- Alerts and notifications: You can set up alerts for transactions over a certain amount, low balance notifications, and more, to stay on top of your account activity.

- Secure login and encryption: The website uses secure login credentials and encryption technology to protect your personal and financial information.

- Mobile access: It offer a mobile app that provides the same features as the web-based, so you can access your information from anywhere using the its website.

These are just some of the many features offered by webpage. So it’s recommended to check the official website for more information.

How to Access MYCARDSTATEMENT ACCOUNT?

After Registering account with MyCardStatement, payments can be made quick and easy process, also view your credit card offers and rewards online. Here are the steps to follow:

- Visit the website of your credit card issuer: Go to the official website that issued your card, such as a bank or credit union.

- Register for online access: If you haven’t already registered for online access, you will need to create an account by providing your personal information and details. This process is usually straightforward and can be completed in a few minutes.

- Log in to your account: Once you have registered, log in to your account using your username and password.

- Find the section: Look for the website and click on the link to access your statement.

- View your statement: You should now be able to view your statement, including your current balance, recent transactions, and payment history. You can also view other account details, such as rewards information and statement preferences.

It’s important to note that the specific steps for accessing the account may vary depending on the credit card issuer, so be sure to follow their instructions. Additionally, be sure to keep your login information secure and monitor your account regularly for any suspicious activity.

Conclusion

Mycardstatement is a valuable tool for managing your credit card information and keeping track of your spending. With its ease of use, convenience, and security features, it’s no wonder that so many people choose to use this feature. So if you want to stay on top of your credit card information and take control of your financial future, consider it.